Streamline Your WBSO Administration Easily with Traqqie

Streamline Your WBSO Administration Easily with Traqqie

Blog Article

Introduction:

Navigating throughout the intricacies of WBSO (Wet Bevordering Speur- en Ontwikkelingswerk) administration can be a daunting undertaking For several enterprises. From accurately documenting R&D pursuits to complying with stringent reporting requirements, controlling WBSO can take in precious time and sources. On the other hand, with the ideal tools and options in place, enterprises can streamline their WBSO administration processes, preserving time and making sure compliance. Enter Traqqie – your top partner in simplifying WBSO administration.

What exactly is WBSO and Why is Appropriate Administration Vital?

WBSO is often a tax incentive provided by the Dutch government to encourage innovation within businesses. It provides a reduction in wage tax or national insurance policy contributions for eligible R&D tasks. Nonetheless, accessing these Advantages requires meticulous administration and adherence to unique pointers set by the Dutch tax authorities. Failure to keep up correct WBSO administration can result in skipped incentives, financial penalties, or even audits.

The Worries of WBSO Administration:

Documentation Load: Businesses ought to preserve in-depth information in their R&D routines, together with task descriptions, several hours worked, and technological enhancements.

Compliance Complexity: Navigating the intricate principles and polices of WBSO could be frustrating, specifically for organizations with confined experience in tax matters.

Chance of Faults: Manual info entry and calculation improve the risk of mistakes, resulting in probable compliance challenges and monetary setbacks.

Time-Consuming Processes: Standard methods of WBSO administration entail important effort and time, diverting methods from Main small business things to do.

How Traqqie Simplifies WBSO Administration:

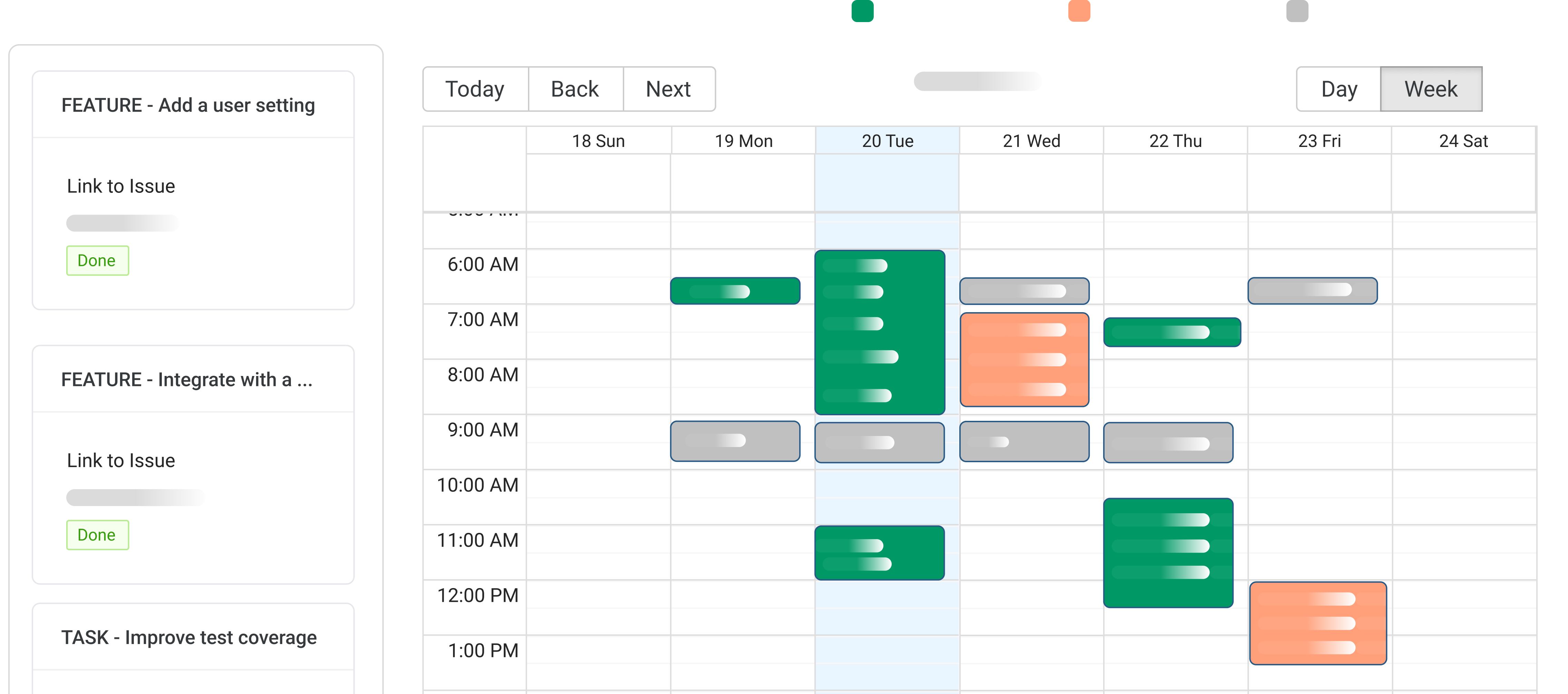

Automatic Documentation: Traqqie automates the documentation process by capturing real-time details on R&D pursuits, eradicating the necessity for guide file-trying to keep.

Thorough Compliance: With Traqqie, firms can guarantee compliance with WBSO rules by means of developed-in checks and validations, lowering the risk of faults and penalties.

Successful Reporting: Make accurate WBSO experiences very easily with Traqqie's intuitive reporting instruments, saving time and means.

Streamlined Workflow: Traqqie streamlines all the WBSO administration workflow, from task registration to submission, creating the procedure seamless and headache-totally free.

Great things about Making use of Traqqie for WBSO Administration:

Time Financial savings: By automating repetitive responsibilities and simplifying processes, Traqqie can help organizations help wbso administratie you save worthwhile time that can be reinvested into innovation and expansion.

Increased Accuracy: Lessen the potential risk of problems and be certain correct WBSO statements with Traqqie's advanced validation mechanisms.

Expense Effectiveness: Minimize administrative fees affiliated with WBSO administration and maximize the return with your R&D investments.

Assurance: With Traqqie managing your WBSO administration, you can have reassurance figuring out that the compliance obligations are increasingly being achieved successfully.

Conclusion:

Successful WBSO administration is critical for corporations looking to leverage tax incentives to fuel their innovation efforts. With Traqqie, organizations can simplify WBSO administration, streamline processes, and make certain compliance easily. Say goodbye for the complexities of WBSO administration and hi to a more effective and successful means of controlling your R&D incentives with Traqqie.